National News

Canada helms G7 talks on critical mineral alliance after U.S.-China détente

Published 10:35 PDT, Thu October 30, 2025

—

Canada is heading up talks to establish a G7 critical mineral production alliance in what's widely seen as a bid to check China's reign over a supply chain key to everything from wind turbines to fighter jets.

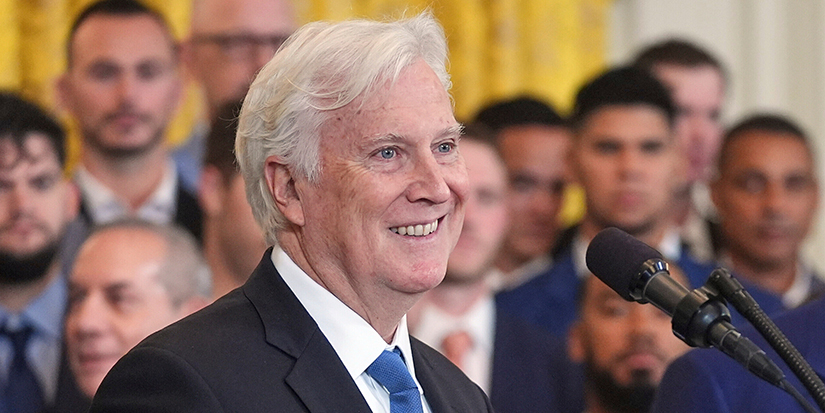

Federal energy minister Tim Hodgson says the critical minerals pact will look at countering market manipulation and price volatility in the sector.

The alliance "demonstrates that competitiveness and conscience can – and must – coexist," Hodgson said as he opened two-day talks with G7 energy and environment ministers in Toronto.

Pressure has been mounting on countries to diversify their supply of critical minerals as China has used its dominant position to tighten exports on rare earth elements often used in magnets for electric vehicles, cellphones, advanced radar and a range of other products.

Just hours before the G7 ministerial talks in Toronto, China announced it had agreed to pause those export restrictions for one year as part of a deal with the United States.

University of Ottawa professor Wolfgang Alschner says that deal helps buy the G7 some time, easing what was "an immediate national security crisis into a high priority policy problem."

But he says it changes nothing about the fundamental issues with China's dominance.

"In a time where geopolitical tensions are rising and where one country can essentially shut off industrial production and even defence protection to the rest of the world, that's a huge problem," said Alschner, who studies Canada's critical mineral strategy.

The International Energy Agency says China accounted for about 60 per cent of global rare earth mining last year, and 91 per cent of global refining production.

The G7 ministerial talks this week are also expected to touch on energy security and continued support for Ukraine.

Canada is trying to leverage its large reserves and its position as a hub for world's mining companies to become a key player in the race for the critical minerals needed to power the energy transition. The federal government has pledged almost $4 billion to its critical mineral strategy with Prime Minister Mark Carney making frequent references to the sector's importance.

Demand for lithium, for example, which is critical to battery and electrical vehicle production, could grow by 11 and 17 times by 2050, according to an IEA forecast.

A G7 critical minerals pact could look at co-ordinated stockpiling of resources and offtake agreements where a government agrees to purchase a portion of mine's output a predetermined price, said Alschner.

Yet, a key question will be whether the United States' "extremely active" pursuit of mineral security will translate into broader partnerships with other G7 countries, he said.

U.S. President Donald Trump has in the past two weeks signed mineral deals with Australia, Malaysia, Cambodia, Thailand and Japan.

While Canada has been "a little bit sidelined," the G7 talks represent a "major opportunity" for Canada as the only resource-heavy mining nation in the pact outside the U.S., said Alschner, the university's Hyman Soloway Chair in Business and Trade Law.

"Is Canada going to be able to deliver and what's the role of the United States? Those are going to be the big takeaways," he said.

– Jordan Omstead, The Canadian Press