International

CSX profit falls 22% as new CEO takes over but performance is expected to improve

Published 2:41 PDT, Thu October 16, 2025

—

CSX's earnings fell 22 per cent in the third quarter as the railroad wrapped up two major construction projects that were limiting traffic, but volume was still up slightly and the results were weighed down by a one time charge.

The Jacksonville, Florida-based company said Thursday it earned $694 million, or 37 cents per share, in the quarter. That's down from $894 million, or 46 cents per share a year ago. But without a $164 million goodwill impairment charge, the railroad would have earned $818 million, or 44 cents per share.

The adjusted figure just topped the 43 cents per share that analysts surveyed by FactSet Research had predicted.

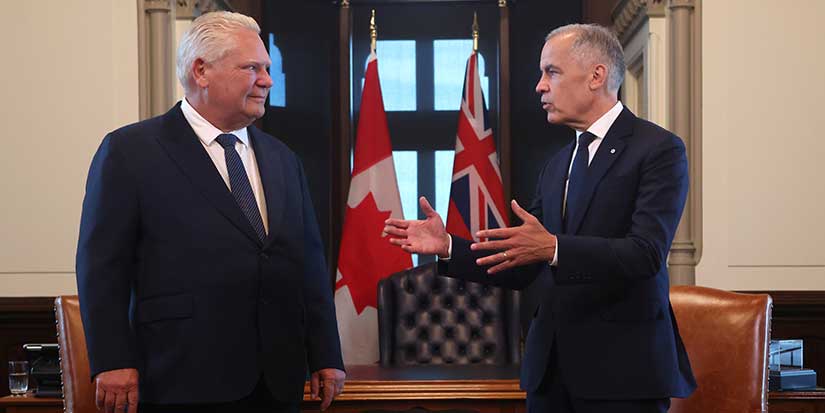

Thursday’s report was the first since new CEO Steve Angel took the job late last month. The railroad is under pressure from investors, such as Ancora Holdings, to find another railroad to merge with, so CSX can better compete with the merged Union Pacific-Norfolk Southern railroad if that $85 billion deal gets approved. But both of CSX’s likely merger partners — BNSF and CPKC railroads — have said they aren’t interested in a deal because they believe the industry can better serve customers through cooperative agreements and avoid all the potential headaches that come with a merger.

Most observers believe CSX and BNSF will be at a disadvantage if the Union Pacific-Norfolk Southern merger is approved. That transcontinental railroad will be able to shave more than a day off delivery times because it won’t have to hand off shipments between railroads in the middle of the country. So far, CSX and BNSF say they can achieve most of the benefits of a merger through cooperative agreements instead.

Angel said his first priority is delivering “best-in-class performance” at the railroad while building a high-performing culture. He said CSX has already received a few inquiries about strategic opportunities that the railroad will pursue if they make sense to customers.

But he cautioned that a major deal doesn't happen every day. Angel said he ran Praxair for a decade before the opportunity to merge with rival industrial gas supplier Linde came up.

“The way strategic opportunities work you have to wait for the right timing,” Angel said. “In the meantime you have to run the company well, so you are going into any conversations from a position of strength so you can capitalize on it."

Angel, 70, has not worked at a railroad before although earlier in his career he worked at GE’s locomotive building unit and developed a lifelong appreciation for railroads. He stressed the similarities between industrial gas companies and railroads, saying both focus on safety and invest heavily in the most profitable areas with the highest traffic.

CSX’s performance has suffered over the past year because of construction projects that limited the railroad’s flexibility and reduced capacity. CSX completed repairs from Hurricane Helene and a major tunnel renovation in Baltimore last month. Its performance improved significantly throughout the quarter. The average speed of its trains increased to 18.9 mph, the fastest level since 2021. CSX also delivered 87% of its shipments on time in the quarter.

CSX is one of the largest railroads in North America, operating in the eastern United States.

– Josh Funk, The Associated Press